Scams are not new, they have always been around, but you need to be aware of how to know a scam. There are hundreds of different scams out there, from investment scams to fake products and holidays, work from home scams, prize draws, lotteries, dating site scams, the list is endless.

Specially now during Covid 19 lockdown many people feel scared, which makes them vulnerable to scammers. When people are feeling scared, they act differently, and might therefore throw their usual caution to the wind.

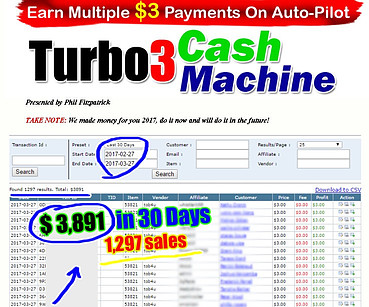

You often get sold on hopes and dreams of what you might or could be making. A lot of hype with people that are successful and therefore you should be joining to achieve the same. A lot of high pressure sales and tactics to try to force you into action that you might regret.

Unfortunately, where there is an opportunity, there are vultures that will prey on the innocent and vulnerable people.

Always use your common sense and trust your instinct. If you are not sure or feel uncomfortable about something, then don’t join them or send money.

Definition of a scam:

A scam is an illegal plan for making money. It is an illegal trick, usually with the purpose of getting money from unsuspecting people. An attempted scam by sending emails in which huge profits are promised in exchange for sums of money that are advanced. It indicates attempted fraud.

A scam can be attempted data or identity theft, by using unethical and fraudulent methods.

A scammer is somebody who uses illegal methods to make money, usually by tricking people. Scammers often sound friendly and well-spoken and will catch you unawares. Scammers almost always rely on people feeling embarrassed and therefore will not talk about it or alert others.

With the fast growth of the digital marketplace, online scam attempts have become far more commonplace. It is good to be properly informed about the dangers you might be exposed to with online scams and how to know a scam.

Examples of Scams:

There are so many scams out there and some are easier to detect than others, but beware when this happens

- You might get a call from somebody that is pretending to be from your bank, saying they want to talk to you about some unusual activity on your account. They will then ask for your account details and password. Don’t fall for it.

- Similarly you might get a call saying that there was a purchase on your credit card and they just need to verify some details with you. Don’t tell them anything.

- Also be aware of e-mail scams, telling you that you have won something, but they need your bank details to deposit the funds for you.

- You might be told that you have a tax refund due to you, and please give us your bank details to deposit the money.

- If you have to sign up to an email list before you can receive further details about the “opportunity”, it often points to a scam.

- Calling “Opportunity Seekers” with an “Action to join” or “Action to sign up”. You don’t have long, go quick, if you don’t act now the bonuses will disappear. The price goes up etc. And do so immediately as there is a deadline looming and the price WILL go up, or you will lose the special deal, or missed the opportunity of the first selected few special people to sign up.

There are many legitimate companies that are selling legitimate courses and products, and here you can see my recommendation for earning passive income online.

Why do people fall for scams?

There are two main reasons why people fall for scams:

- Fear is a huge driver to make people feel vulnerable. Scammers use that fear. Fear of missing out, fear of loss.

- Greed – get-rich-quick, want something without having to put in the work.

When you let fear or greed drive your decisions, it is often the wrong decision.

It is easier to spot a scam if you know what to be aware of and the tricks to look out for:

- If it seems to be too good to be true, then think again. It is called too good to be true because it isn’t true. Get rick quick schemes often promise you lots of money to work online from the freedom of your home, for doing very little work or effort. It that was indeed true, then everybody would be doing it!

- If you get an unsolicited phone call, e-mail or letter, it is often the first warning sign that it could be a scam. When you receive a text message or call from an unidentified caller, don’t trust it. If it is an unsolicited telephone call, then verify the identity of the caller. You can ask for a phone number to call them back. If they can’t or won’t give you a number or it is a wrong number, it is certainly a scam. You can also ask for details about you or your account that only a legitimate caller would have.

- Guaranteed returns is a big alarm. This would be a guarantee that is given on an investment. The value of investments can always go up or down, so unless it is a fixed interest rate with a bank, there is no guarantee that your investment will give you specific rate of return.

- You are asked to share personal details about yourself, your bank detail or account details. These are always to steal your identity and your money.

- Evidence of earnings that is offered with inflated details and testimonials.

- Unique opportunity that appears to be secretive. Complicated language is used to tell you that you have been selected as one of the lucky ones or few who will have or get access to this product or platform. An opportunity that is not available to “regular” or “normal” people.

- A new business model is launched and you can get in early for a special offer or bonuses.

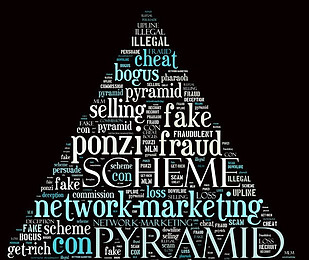

There is “new technology” and you would want to get in at the start. This is typical in a Ponzi scheme or scam, that the people that get in at the start get paid. This keeps them happy and they are then encouraged to “recruit” new people to the scheme. Those “new” recruits bring in the money, but it doesn’t get paid out, so you lose it all.

There is “new technology” and you would want to get in at the start. This is typical in a Ponzi scheme or scam, that the people that get in at the start get paid. This keeps them happy and they are then encouraged to “recruit” new people to the scheme. Those “new” recruits bring in the money, but it doesn’t get paid out, so you lose it all. - Referral is also with Ponzi or pyramid schemes. Family or friends refer you, so somebody else brings you into the company.

- Pressure is put on you to act quickly. There is a sense of urgency as there is a time limit before the special offer expires. It forces you to make a quick decision with persuasive language and you feel bullied. They will make you feel guilty if you don’t sign up, and will tell you that you don’t want to wake up tomorrow regretting not buying or joining and that you have missed out. A bank transfer has the least amount of protection if it does turn out to be fraudulent. You should be given the opportunity to think about it. Certainly avoid them if you feel that you are being rushed to make a decision there and then.

- If it is an investment scam, there will be no 3rd party escrow account. If you ever send anybody money, it goes into a holding account first. When both parties are happy that the transaction has gone through, money gets transferred (PayPal uses that principle that the buyer and seller both need to be happy)

- Conspiracy theories also plays around fear. Government doesn’t want you to know, so before then government shuts us down for telling the truth, buy the product. I recently saw this with a company that was selling health supplements, that they were encouraging people to get in quick before the government shuts them down for telling the truth. Oh really!

- Their contact details are vague, like a PO Box address, rather than a physical address. Or a prime rate phone number or mobile phone number, rather than a land line number. You can check whether they have a website where you can read about them and the services and products that they offer. Research the background of a company or website and look at reviews to warn you about inferior products or services. This is particularly important with financial investments as regulations specifically require them to be registered.

- Spelling or grammatical mistakes. Although mistakes can happen, you will normally find that a reputable and legitimate company will not send out e-mails or promotional material with spelling mistakes and grammatical errors.

- Are you asked to keep it quiet? This is certainly a red flag that you should steer clear from.

Phrases and Terminology that should raise a Red Flag

- You are asked to send money up-front.

- They offer you something for nothing, like you have won an exclusive entry into a prize draw or the lottery.

- Join me today and ask questions later! oh really, I would run a mile

- Expires in 3 hours – limited time

- I would hate you to miss this opportunity

- Only a limited amount of people will have access to …..the product, the service, the good deal that they are trying to scam you for.

- Last few spots left. Yes, that can happen if you are buying movie or concert tickets, but think carefully what it is that you are encouraged to buy or invest in, that only has a few spots left.

Avoid these Pitfalls and Tricks

There are precautions to take to protect and defend yourself better.

- Don’t be tempted to click on links within an email where you are invited to update your details. Those are often phising emails and apart from stealing your identity and money, it can also install malware on your computer.

- Avoid sharing personal information. It might be a pop-up ad claiming that you have won a prize or gift card, but don’t fall for it.

- Contact friends directly about suspicious posts or messages that you might see on their profile.

- Be very cautious with people that you meet online, specially through dating websites. Don’t be tricked by “sudden emergencies” of a death or major accident and you are asked to send them money to help them.

- Always read the fine print. If something is being offered as “free”, but you need to supply them with your credit card details, then the first month might be free. But you might suddenly find that after the first month, you are automatically being charged every month. Those types of subscriptions are very difficult to cancel.

Whether you are looking at investments or products, remember to get your focus right on how to know a scam, and don’t rush into making a decision.

A Pyramid Scheme is a Scam

Do your own due diligence before joining a multi level marketing or network marketing company. Many companies hide behind a product, while they are in fact just a pyramid scheme in disguise. If the focus is on recruiting and promoting more people, rather than selling the product, it often points to it being a pyramid scheme.

If less than 3% earn all, or most, of the money within the program, it also fits the description of being a pyramid scheme. So ask yourself – Am I working for a pyramid scheme? When a company is relying on recruiting more people to drive the business forward, it points to be a pyramid scheme.

If you don’t know exactly how you will be earning your money, then it is often better to walk away from it.

If you are promoting something that ends up being illegal, then you are also liable and might be prosecuted. It is not only the owners, it is everybody in the down line that is involved as well. The principle is the same as being an accomplice (in a murder, robbery, theft etc.)

A common tactic used by companies, is to invite you to a meeting or seminar and try to rope you in. If it is a live event, they will create even more pressure and hype for you to join and sign up. They subtly try to warm you up to an idea.

So don’t fall for these traps.

I just got Scammed!

Have you been the victim of a scam? People that have been scammed, often feel embarrassed about it, and therefore keep quiet and don’t tell anybody. That is exactly what the scammers want you to do, so that they can defraud more people.

So it is very important that you share your story with as many people as possible, so that they don’t get tricked as well.

What to do when you think you have been scammed:

- Online scams can be reported to the appropriate government agency of your country.

- Report it to the police and financial institutions.

- Share with people in your circle when you are aware.

- If the scammers are using social media to lure unsuspecting victims in, then report it to the social media platform that they can remove it or put up a warning.

Stay vigilant and safe from the Conman

Fortunately there are many ways to make a passive income online, without becoming involved in scams or pyramid schemes. An online business is often far more cost-efficient, and with a low barrier to enter into creating an online business. My recommendation to earn a passive income online, is to join Wealthy Affiliate. This is where you can read my review about them.

More about how to spot an on-line scam is available from wikiHow.

I hope you will recognize how to know a scam, but if you do have any suggestions or questions, please leave them below and I will get back to you.

I’m going to print these red flag phrases and put it on mt grandparents fridge! I found out a lot of phone scammer target elderly people, which is just downright disgusting. And they’re easy targets..they don’t keep up with the world changing so fast around them and they don’t think about scams.

I’m really thankful that you wrote this post, I hope a lot of people read it and remember it.

Are there any other “bad rep” schemes, beside a pyramid that we should be aware of?

Again, thank you!

Katya

Hi Katya, I agree with you that it is despicable how scammers target the elderly and vulnerable people. Great idea to put the red flags on your grandparents’s fridge. Look out for MLM companies that have very complicated commssion structures and place more emphasis on recruiting than selling.

Line, this was an interesting post. Scammers are getting more devious these days. If they get caught out one way, they are soon thinking up another way to get to your money! The internet is the scammer’s playground and so it is vital to find a safe space from where to operate and grow a business. Thanks for your 14 signs!

Hi James, it is amazing how scammers keep on coming up with new devious ways of conning people. They would be better off channeling that energy into something positive. But we all need to stay alert and if is something doesn’t feel right, then trust your instinct

The moment you say “I just got scammed!” kind of resonate with me.

It reminds me of the past experience I’ve been trapped by illegal scammers…angry, upset, sadness…I can’t do anything about it when I know I can’t get back my money again.

You include a lot of great points of differentiating SCAM. Your article will save a lot of people.

Hi Zac, my dad, as he grew older was scammed a few times, and he kept on thinking he would get his money back, which was very sad, upsetting and frustrating. Best is to take time to make a decision and think carefully what you are being lured into. Then use common sense.

This was really eye-opening. People are generally trusting and scammers take advantage of trusting people. Especially when it comes to technology, people very often give out personal information because the other person sounds legitimate and “helpful”. I tend not to trust anyone cold calling me and only deal with people I’ve asked for information. You might lose out on a small number of legitimate deals but for the most part, you’ll be better off.

Hi Jenny, I tend to be suspicious if I get an unsolicited call, but unfortunately many people are not. It is shocking how scammers will target the elderly and other vulnerable people, but many people do fall for them. It is important to think twice if you are being rushed to make a decision.

Good information, especially now when scammers seem to be even more present during the pandemic. I know that scammers are trying to get rich quick and they use scam techniques to do so. But it seems it is often those who can least afford the money outlay who fall for their traps.

I really appreciate you bringing all of this out in such a detailed post. I’ll be sharing with my social media community in an effort to warn others.

Hi Diane, It is shocking how scammers target vulnerable people. It is as you say, it is often those that can least afford to lose money, that end up being scammed. You are welcome to share the post to warn more people. Liné

Hi there and thanks for your insightful review. I agree that there seems to be more of these scams everyday. It is also true that when people are feeling vulnerable or scared that they are easier to target. Like many people I have looked for ways to make extra money online. Once you start looking around he internet it doesn’t take long before your inbox is getting inundated with spam of all sorts.

While checking for reviews on these opportunities that sounded to good to be true, I came across a review explaining why this so called opportunity was not as advertised and should be avoided. However, this review also had a link to Wealthy Affiliate. I knew that the WA opportunity was different because it actually required real work. When the opportunity came with training, I was convinced that this was the real deal.

Cheers,

David

Hi David, It is good to know what to look out for that you don’t get scammed. Liné

Thank you for this great information. This is a extremely well written article and I am going to pass it along to a number of my colleagues.

Thank you Richard, you are welcome to share the post to help more people to avoid scams. It helps if one knows what to look out for. Liné

Hello

Thank you so much for sharing with us your helpful article your article is so helpful, right now There is a lot of scammers are trying to get rich quick and they use scam technique, I am going to sharing with my social media community this helpful article t again thanks a lot for sharing that with us.

Hi Nathan, you are welcome to share my post that more people can be aware of scammers and the techniques they use to con people. All the best, Liné

Thank you, thank you, thank you. Some of these are just such blatant signs of a scam and yet I’m amazed that people still get roped into them!! I suppose the temptation of making quick and easy money has always had an allure. The cold truth is often that if it sounds too good to be true, then it probably is too good to be true. Thanks for the solid pointers for spotting a scam!

The temptation of making money is certainly a big lure. But unfortunately people also hand over credit card and bank details when they receive a scam email or phone call from somebody that is posing as a bank official. Some scams are very sophisticated, so we all need to stay vigilant.

Hi Line

Thanks for sharing an excellent information on 14 signs to know the scam. Apart from this science Phrases and terminology that raise The Red flag caught my attention .they are so true and I have been through some of the Rough experiences myself .thanks for indicating the precautions to be taken to avoid pitfalls and tricks .I can bet that staying vigilant is the only way to keep ourselves safe

Thanks and regards,

Gaurav Gaur

You are quite right that we all need to stay vigilant to stay safe from scams.

Thank you for these frank and honest tips about what exactly is a scam, with details and examples of what it looks like. I have been a victim of 2 scams. The first one seemed to have come from my bank. Everything looked legit in the email and on the first ‘go to’ page. I innocently signed in with email and password and later found that it was a scam. The second one was an MLM scheme. I heard all these glowing testimonials and felt that if it worked for people I knew, then it should work for me. Wrong. The recruiting targets were impossible and the mandatory sales income was too hard. Thanks for the details.

It is scary how many people do fall for scams and how difficult it is to sometimes detect a scam. I am sorry to hear that you have been a victim as well.